Housing has historically been an avenue for sizeable expenditure for each se and expense opportunity for prime Internet-really worth People, Financial establishments and also people investigating viable alternatives for investing dollars among stocks, bullion, property and other avenues.

Dollars invested in property for its cash flow and capital progress presents stable and predictable cash flow returns, comparable to that of bonds giving both a regular return on expenditure, if residence is rented as well as likelihood of funds appreciation. Like all other financial investment alternatives, housing financial investment also has particular hazards connected to it, and that is quite different from other investments. The obtainable expenditure chances can broadly be categorized into residential, commercial Place of work Area and retail sectors.

Expenditure situation in property

Any investor just before thinking about property investments ought to consider the risk linked to it. This financial commitment solution needs a higher entry rate, suffers from deficiency of liquidity and an uncertain gestation period. To remaining illiquid, one particular can not sell some models of his home (as 1 might have carried out by advertising some units of equities, debts or simply mutual money) in the event of urgent need to have of resources.

The maturity period of residence expense is unsure. Trader also has to check the obvious property title, especially for the investments in India. The field authorities in this regard claim that residence investment need to be carried out by individuals which have deeper pockets and more time-time period check out of their investments. From a prolonged-expression economical returns viewpoint, it is actually recommended to invest in greater-grade commercial properties.

The returns from home marketplace are comparable to that of specific equities and index money in longer time period. Any Trader in search of balancing his portfolio can now think about the real estate property sector to be a protected signifies of investment decision with a certain diploma of volatility and possibility. A suitable tenant, area, segmental categories of the Indian assets sector and particular person chance preferences will hence forth prove to generally be essential indicators in attaining the target yields from investments.

The proposed introduction of REMF (Housing Mutual Money) and REIT (Real Estate Investment Rely on) will Enhance these property investments with the little traders' standpoint. This will likely also permit modest traders to enter the housing marketplace with contribution as a lot less as INR 10,000.

There is certainly also a demand from customers and need from distinct current market gamers with the property segment to slowly relax specific norms for FDI With this sector. These overseas investments would then mean larger criteria of high-quality infrastructure and as a result would alter the overall current market situation regarding competition and professionalism of sector gamers.

Over-all, housing is predicted to supply a very good investment decision alternate to shares and bonds over the approaching yrs. This attractiveness of real-estate expenditure will be more Increased on account of favourable inflation and very low curiosity price routine.

Seeking ahead, it is achievable that With all the development in direction of the feasible opening up of your real estate property mutual funds marketplace as well as the participation of monetary institutions into residence expenditure company, it can pave the way in which For additional structured investment real-estate in India, which might be an apt way for buyers to acquire a substitute for invest in home portfolios at marginal stage.

Trader's Profile

The 2 most active investor segments are Substantial Web Worth Men and women (HNIs) and Economical Institutions. Although the establishments typically exhibit a preference to industrial investment decision, the significant Web worthy of people today show desire in buying residential and also business Houses.

Aside from these, will be the third category of Non-Resident Indians (NRIs). You will find there's crystal clear bias in the direction of investing in household Attributes than business Homes through the NRIs, the fact could be reasoned as psychological attachment and long run protection sought through the NRIs. As the necessary formalities and documentation for purchasing immovable Homes apart from agricultural and plantation Qualities are fairly simple plus the rental profits is freely repatriable exterior India, NRIs have enhanced their position as investors in real estate property

Overseas direct investments (FDIs) in real estate property type a little portion of the overall investments as there are constraints like a minimum lock in period of three several years, a least dimension of residence to become designed and conditional exit. In addition to the problems, the overseas Trader must deal with a amount of presidency departments and interpret lots of sophisticated legislation/bylaws.

The concept of Property Financial commitment Trust (REIT) is around the verge of introduction in India. But like most other novel fiscal instruments, there are likely to be troubles for this new strategy being recognized.

Housing Expense Have confidence in (REIT) can be structured as a firm committed to possessing and, usually, working revenue-generating real-estate, for example apartments, shopping centres, workplaces and warehouses. A REIT is a company that purchases, develops, manages and sells real-estate belongings and lets individuals to take a position inside a skillfully managed portfolio of Houses.

Some REITs also are engaged in funding real-estate. REITs are pass-as a result of entities or corporations that have the ability to distribute nearly all income dollars flows to investors, without the need of taxation, at the corporate amount. The main reason of REITs is always to go the profits to your investors in as intact method as possible. That's why initially, the REIT's organization activities would normally be limited to era of residence rental income.

The position of your Trader is instrumental in scenarios where the desire of the seller and the buyer usually do not match. One example is, if the vendor is eager to provide the property as well as the identified occupier intends to lease the residence, between them, the offer won't ever be fructified; on the other hand, an investor can have aggressive yields by buying the home and leasing it out for the occupier.

Rationale for real-estate financial commitment techniques

The action of real estate involves an array of pursuits like progress and construction of townships, housing and business Qualities, maintenance of present Houses and so forth.

The construction sector is 1 the best employment sector from the economic climate and directly or indirectly influences the fortunes of many other sectors. It offers employment to a significant work force such as a considerable proportion of unskilled labor. Even so For a lot of explanations this sector does not have sleek access to institutional finance. This is certainly perceived as one of the reasons with the sector not executing to its opportunity.

By channeling tiny discounts into property, investments would enormously boost entry to arranged institutional finance. Enhanced action inside the home sector also increases the earnings flows to your Point out exchequer by-elevated income-tax, octroi and other collections.

Property is a vital asset class, and that is below typical circumstances not a viable route for investors in India at present, except by means of immediate possession of Homes. For numerous traders enough time is ripe for introducing merchandise to empower diversification by allocating some aspect of their financial commitment portfolio to property expense goods. This can be effectively obtained as a result of real estate property money.

Home investment products deliver possibility for capital gains as well as common periodic incomes. The money gains may crop up from Homes formulated available for sale to actual people or direct traders and also the profits stream arises out of rentals, cash flow from deposits and service fees for property servicing.

Advantages of financial investment in property

The following are the advantages for investing in Real-estate Expenditure Techniques

• Being an asset class, residence is distinctive from another financial commitment avenues accessible to a small and also significant Trader. Investment decision in house has its have methodology, positive aspects, and risk aspects that happen to be unlike Individuals for regular investments. A very distinctive set of components, including cash development, financial general performance and provide criteria, impact the realty current market, bringing about a very low correlation in cost behaviour vis-à -vis other asset lessons.

• Historically, above a longer time period, real estate property delivers returns which might be similar with returns on equities. Nevertheless, the volatility in costs of realty is reduced than equities leading to a better hazard management to return trade-off for the financial investment.

• Real estate returns also clearly show a significant correlation with inflation. As a result, real estate property investments made over very long periods of time present an inflation hedge and yield authentic returns

Hazards of expense in real estate property

The challenges involved in investing in housing are generally to perform with future rental depreciation or basic assets industry possibility, liquidity, tenancy risk and house depreciation. The fundamental things impacting the value of a particular house are:

Site - The situation of a creating is crucially significant and an important Think about figuring out its industry worth. A house financial commitment is likely for being held for many decades and the attractiveness of a offered place could modify in excess of the holding period, for the higher or worse. For instance, A part of a town may very well be going through regeneration, through which situation the perception of The situation is likely to improve. In distinction, An important new shopping mall advancement might lessen the attractiveness of current peaceful, household Attributes.

Actual physical Qualities - The sort and utility with the creating will impact its price, i.e. an Business or possibly a shop. By utility is supposed the advantages an occupier gets from making use of space in the creating. The chance aspect is depreciation. All structures endure don and tear but developments in making engineering or the necessities of tenants may also render structures fewer desirable eventually. As an example, the need for big magnitude of underneath-ground cabling in contemporary city workplaces has adjusted the technical specs of the necessary structures' Room. Also, a making which happens to be developed being an office block may not be usable as being a Cineplex, however Cineplex may well serve greater returns than Office environment House.

Tenant Credit rating Possibility - The value of a building is really a function of the rental income which you can count on to receive from proudly owning it. If your Belize Real Estate tenant defaults then the proprietor loses the rental money. However, it is not just the potential risk of outright default that matters. When the credit history high-quality of the tenant ended up to deteriorate materially through the duration of ownership then the sale price will very likely be worse than it usually would have been.

Lease Size - The duration in the leases is also an important thought. If a setting up is Allow to your good quality tenant for an extended interval then the rental cash flow is confident even though sector situations for residence are risky. This is probably the attractive functions of residence expense. Since the size of lease is a big function, it is necessary at enough time of order to consider the size of lease at the point in time once the residence is probably going to generally be re-occupied. Many leases incorporate crack options, and it's a typical industry apply to presume that the lease will terminate at the break point.

Liquidity - All assets investment is relatively illiquid to most bonds and equities. Home is slow to transact in normal marketplace circumstances and hence illiquid. In poor market situations it will take even longer to find a buyer. You will find there's substantial cost of error in property investments. Consequently, even though a Incorrect inventory investment decision can be offered immediately, undoing a Mistaken real estate financial commitment could be monotonous and distress method.

Tax Implications - In addition to earnings tax and that is to become paid out on rental profits and cash gains, there are two a lot more levies that have to generally be compensated from the investor i.e. house tax and stamp obligation. The stamp responsibility and assets tax differ from state to state and may affect the financial investment returns ones expected from a home.

Large Price of Expenditure - Real estate property values are significant compared to other types of investment decision. This character of property expenditure puts it from attain in the widespread masses. Then again, stocks and bonds can now be acquired in quantities as tiny as-a single share, Hence enabling diversification from the portfolio despite lower outlays. Borrowing for investment in real estate property enhances the challenges more.

Risk Of Solitary Home - Paying for one - home exposes the Trader to certain risks associated with the house and doesn't present any advantages of diversification. So, In case the assets selling prices fall, the investor is exposed to a superior degree of hazard.

Distress Product sales - Illiquidity of your property current market also provides in the chance of decreased returns or losses in the function of an urgent need to divest. Distress income are common during the real estate property marketplace and bring about returns that tend to be decreased compared to the honest worth of the house.

Authorized Troubles - Even though stock exchanges promise, to a particular extent, the legitimacy of a trade in equities or bonds and thus protect against bad delivery or fake and cast shares, no identical security net is obtainable inside the home marketplace. It is also difficult to Look at the title of the home and demands time, revenue and abilities.

Total keeping track of marketplace traits can lessen The majority of these dangers. For instance, purchasing Qualities where the rentals are at current market charges, also, buying assets that come with superior-credit score tenants and looking for lease lock-ins to reuse tenancy chance are simple tips to adhere to.

Upcoming Outlook

The property current market is witnessing a heightened exercise from year 2000 equally in terms of magnitude of Room staying developed and also rational rise in rate. Straightforward availability of housing loans at Substantially lesser rates has inspired people who find themselves small investors to purchase their unique dwelling, which could be their next dwelling too.

High net worth people have also demonstrated higher zeal in investing in household housing having an intention of reaping funds appreciation and concurrently securing standard returns.

While in the wake of sturdy economic development, housing sector should really continue on to realize momentum resulting in slipping vacancies in CBD regions and a lot more advancement in suburbs; it's not likely that industrial property selling prices will rise or tumble appreciably, over and above rational reasoning.

Because the stamp responsibility on depart and license agreements has been even further lowered, it should really even more attract to deal During this method encouraging the buyers as well as the occupiers.

With present-day price range specializing in infrastructure, it'll bring in high quality tenants and increase to industry expansion. Heighten retail activity will give upward press for Place need.

More, the proposed introduction of REMF (Real estate property Mutual Resources) and REIT (Real Estate Expenditure Rely on) will Increase these real-estate investments with the smaller buyers' viewpoint. These overseas investments would then signify bigger benchmarks of quality infrastructure and hence would alter the full sector state of affairs concerning competition and professionalism of market gamers.

Hunting forward, it is possible that with obvious methods in the feasible opening up of the REMF field plus the participation of financial establishments into house expense company, it will pave how for more structured expenditure in property in India, which might be an apt way for retail investors to receive an alternative to spend money on property portfolios in the least ranges. Over-all, property is anticipated to provide a great financial investment substitute to shares and bonds around the coming several years.

Jaleel White Then & Now!

Jaleel White Then & Now! Ralph Macchio Then & Now!

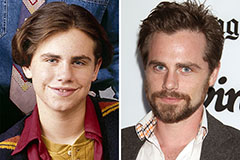

Ralph Macchio Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!